Does money overwhelm you? Are you not sure where to start to get your money and finances in order? Are you drowning in debt? Do you swipe that credit card without thinking, and figure oh I will just pay it off later? Want less stress related to money? If you answered YES to any of these questions then I am here to help you take control of your Money and Finances! The goal of this blog series is to help you to learn how to budget and how to stick too it! I will also share some of my cost saving ways along the way! I have timed the release of the blog with this upcoming holiday season, as I am hoping to help you get your finances in control and have a plan to start 2019!

Taking Control of Your Money

My Finance Story

I have personally always been a saver but easily found that once we bought our house back in 2015 that we needed to tighten our finances or we could have easily found ourselves out of control and drowning in debt and becoming house poor. The biggest challenge for our family is that as a supply teacher I don’t have a stable income, so my pay check is almost never the same amount making sticking to a budget a huge challenge and even more necessary! I also live 12 weeks of the year on unemployment pay (55% of my income) and have for the last 6 years as finding a permanent teaching job in our area is quite a challenge. Now fast forward to 2018, we knew that when Thumper was born that we would be living the whole year on that 55% salary plus my husbands income, so again we looked for ways to cut costs and to live within our means as we didn’t want to take on any debt. We are now in month 8 of the reduced income and I can say that we have not taken on any debt at all, and actually have managed to pay down one car loan faster and put away some savings for next years daycare costs.

Gaining Control of Your Money

The first step to gaining control of your money is to change your mindset about money and focus on the long term goals rather than the small sacrifices you will need to make. For example, a year ago we cut cable which seemed like a big deal at the time however a year later we don’t even miss it and have found ways around it and instead put that $70 to other things. Small changes can make a huge difference in your overall money situation, even the simple change of bringing your own coffee or tea to work can save.

Here is some enlightening math: Medium Tea at Time Hortons – $1.90/ day x 20 work days = $38 a month plus the tea we bought on weekends when we were out, I would say I was spending $50 a month on tea… that’s just crazy. I definitely have noticed the difference as while on maternity leave I make more tea at home and have money leftover at the end of the month in my fun money category rather than having spent it all at the end of the month.

So sometimes I do buy a tea while out, now I have recently switched to buying at Mcdonald’s where my Large Tea and muffin cost $2.10, and was awakened this week as to why I switched as I ordered the same thing at Tim Hortons and paid $3.95. So every time I order at McDonald’s I save $1.85, plus every 7th tea is free. Here’s some more math to consider, if I buy a muffin and tea just twice a week in a month there’s a difference of $15.65!

8 Large Tea and Muffin – Cost at McDonald’s = $15.95, Cost at Tim Hortons = $31.60

Getting Started – Taking Control of Your Money:

My advice is based upon financial knowledge that I have gained from Dave Ramsay, Gail Vax-Oxlade and many other financial sources that I have researched over the years. If you are willing to be consistent and put in effort then you are sure to find success in getting and staying out of debt and learning to live within your means. In order to be successful you need to be all in, and work as a team with whoever you share finances with. Now for some of us this isn’t going to be easy as the first step is facing up to where your money is going, and stop hiding from the reality of our own money situations. Disclaimer: I do not have a financial background – this advice is just based on what I have learned over the years.

Step #1: How should your income be spent?

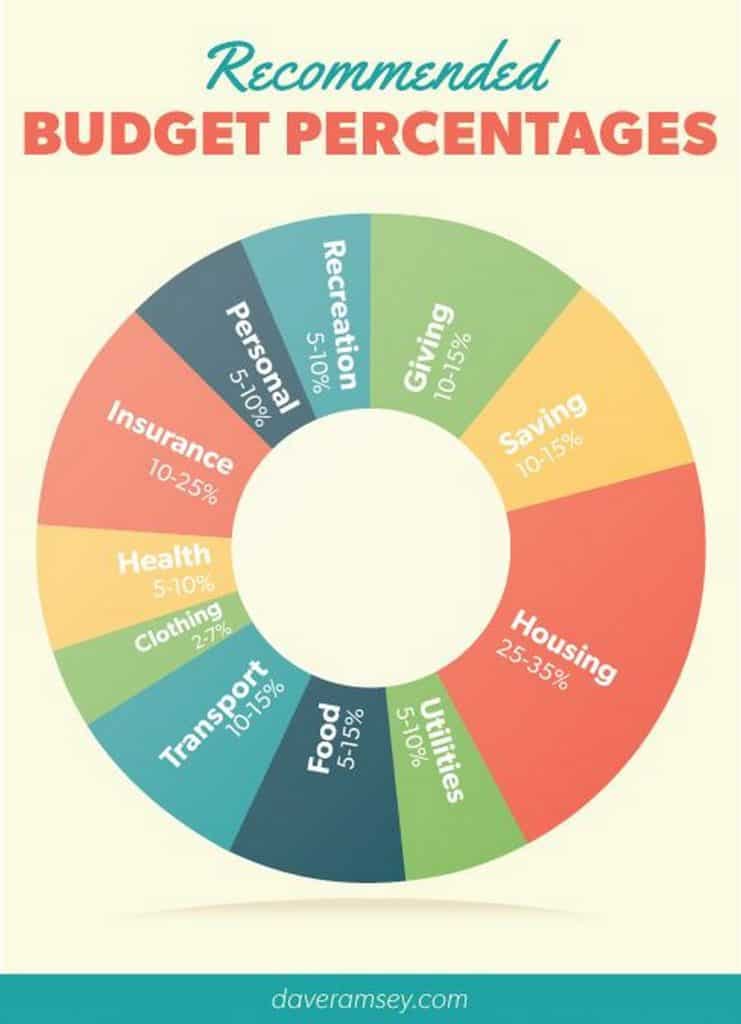

Based on studying advice from Gail Vaz Oxlade and Dave Ramsey they both agree and have similar advice to percentages of where money should be spent, which is what I used when determining our budget.

The following are percentages that should be used when creating a budget.

- 35% HOUSING (mortgage/taxes, rent, home insurance, utilities: hydro, water, gas, and maintenance)

- 15 % TRANSPORTATION (car payments, gas, parking, repairs, insurance, transit pass)

- 15% DEBT REPAYMENT

- 10% SAVINGS

- 15% FOOD

- 10% LIFE (entertainment, medical, other)

Now if your lucky and don’t have any debt or have finished paying it off then you can reassign your 15% elsewhere! So now that you know how much approximately belongs in each category, you can start to get an idea of how much money should be in each category based on your income. For now this is just for information, we will use this more in Blog #2 in the Series: Creating a Budget

Task #1: Track your Income and Expenses

Write Down Your Total Income

This is your total take-home (after tax) pay for both you and, if you’re married, your spouse. Don’t forget to include everything—full-time jobs, second jobs, freelance pay. Include all jobs or money coming in, including things like HST, GST rebates, Canada Child Benefit.

Write Down All of Your Expenses

List all of your regular bills: mortgage or rent, gas, utilities: gas, hydro, water, insurance: home, car, life, property tax, car payments, childcare. Then list other costs such as groceries, gas, entertainment, clothing, pet expenses. You should track every dollar for the previous month to get an idea of where you spend your money. Checkout the Expense and Income Printable to help you out!

Don’t forget to Protect Yourself from Your Finances!

Some other great Money and Savings Blogs

- Money Savings Apps

- Save Money on Your Cell Phone

- Teaching Children about Money

- Kids and Money

- Saving for Children’s Education

Erin A well research article. Can you show me the money. I agree with you it is important to track all of your expenses opposite an income you receive. ie Take Care of Business.

Making tea and coffee at home seems like such a small change, but if you make a lot of small changes they can add up to a lot of savings! Especially when takeout coffee costs so much. We noticed a big difference when we bought a coffee maker and made coffee at home each day.