Canadian mothers are so lucky to have paid parental leave, however the choice of taking a 12 month maternity leave or 18 month maternity leave can be difficult. In 2017, the Canadian government introduced the 18 month maternity leave to parents. This blog will look at the differences between a 12 or 18 Month Parental Leave and all of the financial factors to consider before deciding.

Deciding how long of a maternity leave to take can be both an emotional decision (wanting to stay home with your child) and a financial decision (can you afford to stay on a reduced salary for longer), and is even trickier as a new mother to make when dealing with pregnancy hormones.

For the longest time. we put off having a child as we never felt financially ready or financially stable while all my friends would say “you are never financially ready but that you just figure out how to make it work”. So in 2018, we finally took the plunge and decided we were ready to have children.

Once you are actually pregnant you are excited at expanding your family, however the reality of a reduced income soon hits and you have to begin to determine how you will make your financial situation work.

It is important to know all about how maternity leave works in Canada as not everyone qualifies so this is vital information, as you need to apply, it doesn’t just automatically happen when you have a baby. Here is what you need to know about maternity leave in Ontario.

12 or 18 Month Parental Leave – Deciding on Your Options

18 Month Maternity Leave and How it Works:

*Now I am not an expert, nor an employer of Service Canada so all information presented is guidance and should be followed up with a phone call to Service Canada if still unclear.

The following information will help you understand Maternity Leave Financial Math and how the 18 Month Maternity Leave works.

With both of my maternity leaves in 2018 and 2021 I chose the 12 month leave as it financially made the most sense for our family but this isn’t always the case for each family.

Now maternity and parental leave is a huge financial challenge as you are not only living on a reduced income (55% of your salary on Canadian EI) but your expenses have been increased as you need to buy diapers, wipes, formula, clothes and baby gear.

You may also be interested in: Baby on a Budget: Tips to Save on the First Year or How to Save Money on Diapers, and Canadian Baby Registry Options.

What is Maternity Leave? What is Parental Leave Option? How Long is Maternity Leave in Canada?

The paid parental leave program in Canada has two benefits: Maternity Leave and Paternal Leave which offer multiple weeks of leave to eligible employees in Canada. The number of weeks of maternity benefits and parental benefits are different when you have a new child. To be considered eligible you must have worked 600 hours in the past year (365 calendar days) before having the new baby.

Canadian maternity leave allows mother to have a combined 50 weeks off between Maternity Leave and Parental Leave. Maternity Leave is 15 weeks long and is only eligible to the birth moms of a child, while Parental leave is 35 weeks long (about 9 months of parental leave) and is eligible to both parents whether biological or adopted.

12 Month Maternity Leave

An important not is that all benefits must be used within 52 weeks of the child’s birth. Maternity leave in Canada allows mothers time to adjust to being a parent and to heal from the process of birthing a child. Parental Leave in Canada allows either parent time to take time off to care of their newborn, while their job is secured. This amount to just under a year long maternity and parental leave combined.

18 Month Maternity Leave

Extended Maternity leave allows mothers to have a combined 61 weeks off between Maternity Leave and Parental Leave. Maternity Leave is 15 weeks long and is only eligible to the birth mother of a child, while Parental leave is 46 weeks long and is eligible to both parents whether biological or adopted and offers extra time.

Changes to Maternity and Parental Leave in Canada: New Benefits

New in 2018

The Government of Canada created the option of an 18 month maternity and parental leave program which includes 15 weeks of maternity leave and 61 weeks of parental leave. The maternity leave policy in Canada is constantly changing and being improved to try and combat the changing of families and roles in the household.

New in 2019

Every dad should have the opportunity to take paternity leave – not only does it allow them to spend time with their young children, but I also think it makes them better fathers and husbands as they have a better understanding of what it takes to care for a child all day long. By having dads stay home this also breaks home the age old gender stereotypes that in 2018 are no longer relevant as women have jobs just as men do and in many cases can be the bread winner of the family.

Canadian maternity leave law states that businesses must allow fathers to take time off if they request it, and must hold their jobs. Quebec has for years encouraged fathers to take time off with their children and as a result 87% of fathers in Quebec have taken a parental leave, and as a result it has shown positive for kids.

As of June 2019, the Federal Government of Canada will introduce a 5 week use it or lose it incentive for new fathers to take parental leave. The way it will work is that fathers can take up to 5 weeks off in addition to the mother’s maternity and parental leave, adding up to a total of 55 weeks paid by employment insurance but only if both parents take time off work.

New in 2021

If parents are both taking parental benefits then dads are now eligible to take up to 8 weeks without taking away weeks from the opposite parents leave, this will allow families to take a total of 69 weeks.

When sharing, the maximum number of weeks available increases to:

- 40 weeks for standard parental

- 69 weeks for extended parental

Important Notes: The remaining 5 weeks of standard or 8 weeks of extended parental benefits are available on a use-it-or-lose-it basis: if taken, they can only be taken by the other parent(s). Parents can receive their weeks of benefits at the same time or one after another. Dads do not need to take the weeks consecutively however they must be taken within 52 weeks if 12 month option is chosen and 69 weeks if the 18 month option is chosen.

Important Terms in Regards to Maternity and Parental Leave:

Reference From Service Canada’s Website

EI maternity benefits are payable only to the biological mother who is unable to work because she is pregnant or has recently given birth. To receive maternity benefits, you need to prove your pregnancy by signing a statement declaring the expected due date or the actual date of birth.

EI parental benefits are payable only to the biological, adoptive, or legally recognized parents while they are caring for their newborn or newly adopted child or children. To receive parental benefits, you must sign a statement declaring the newborn’s date of birth or, when there is an adoption, the child’s date of placement for the purposes of the adoption and the name and address of the adoption authority. In cases where the child is not legally adoptable, parental benefits could be payable from the date you attest that you consider the placement a permanent one. In these circumstances, the Commission may, at any time, request proof certifying that the child for whom you are claiming parental benefits has been placed with you by a recognized authority and that the placement was not merely a temporary one.

For biological or legally recognized parents, EI parental benefits can be paid starting from the child’s date of birth. For adoptive parents, parental benefits can be paid starting from the date the child is placed with them for the purpose of adoption. In cases where the child is not legally adoptable, parental benefits could be payable from the date you attest that you consider the placement a permanent one.

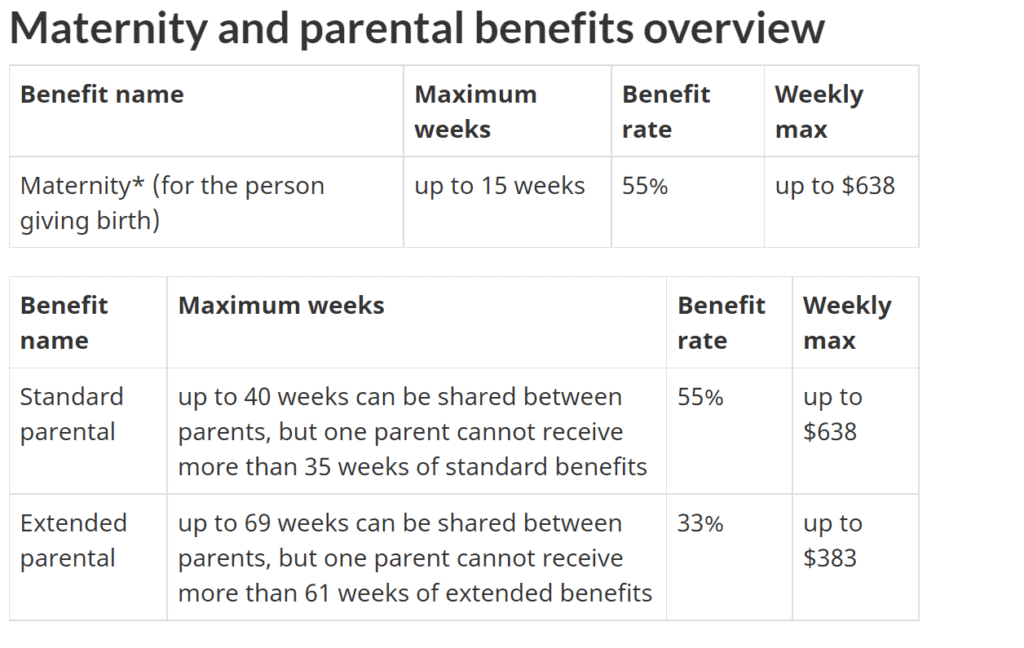

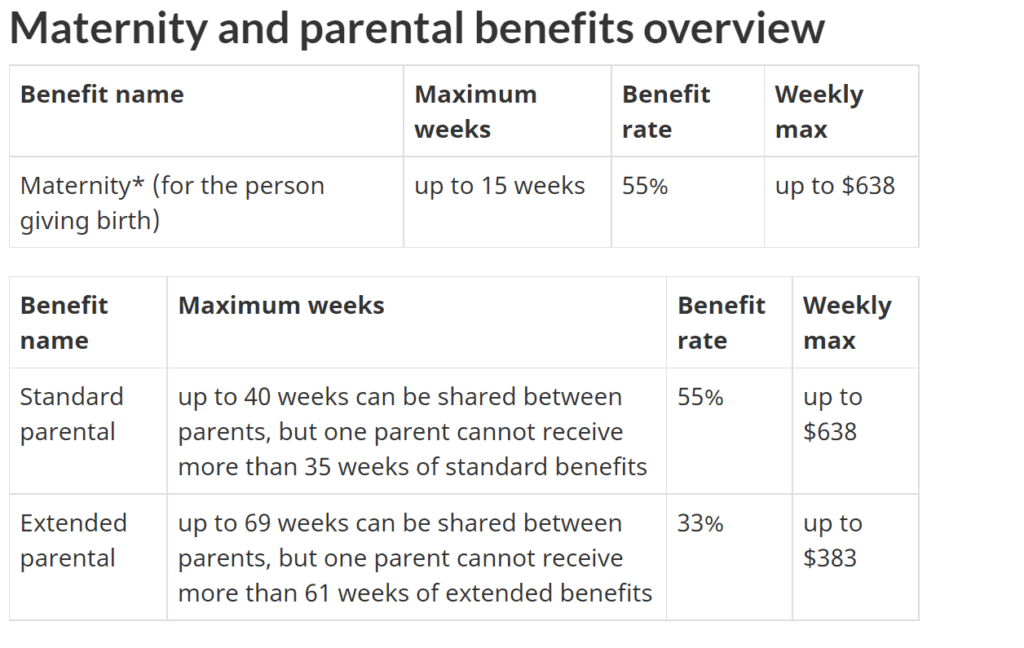

Maternity Leave Benefits and Parental Leave Benefit Options: Benefit Amounts

Adding a new family member is exhausting and stressful on it’s own so planning ahead and determining what your benefit amounts will be during your maternity leave or extended parental leave is important to reduce stress and financial worries once baby has arrived.

12 Month Parental Leave: Standard Parental Benefits:

A 12 month Parental Leave pays 55% for the entire 50 weeks, 15 weeks of maternity benefits that are available to biological mothers or surrogate mothers that cannot work due to pregnancy. Standard parental benefits can be accessed as early as 12 weeks before the baby is born.

18 Month Extended Parental Leave Benefits

The 18 Month Maternity Leave does pay slightly more than a 12 month maternity leave however you need to extend this money for an additional six months. Determining how much money you will get paid is a big part of the financial decision. A 18 Month Parental Leave pays the same 55% for the first 15 weeks of maternity leave, and then for the remaining 61 weeks, the parent is paid at 33%. This can also be extended to a total of 69 weeks if the opposite parent takes parental leave as well. If you choose the 18 month leave then you will apply for Extended Parental Leave that will automatically start after maternity leave.

How much money does Canadian Maternity Leave Pay? What is the Maternity Benefit pay rate? What is the Parental Leave Benefit Rate? Use these amounts to figure out a budget for Maternity Leave.

Maternal leave in Canada is paid at 55% to a maximum yearly insurable salary of $60,300 based on your average weekly insurable earnings. This means the maximum amount that anyone can be paid is $638 per week pre tax. Pregnancy leave also known as maternity leave can be taken up to 12 weeks before baby is born but these weeks before baby is born come out of your total of 15 weeks of maternity leave. There are lots of things to do before baby comes but I highly suggest you figure out where, how, and when to apply for benefits as it can be a lengthy process.

The rate of Employment Insurance benefits depends on the option you choose:

Employment Insurance maternity benefits in Canada is 15 weeks and paid at 55% regardless of the parental benefit option you choose. Maternity leave policy in Canada can only be taken by the biological mother. Maternity pay is a maximum of $638 a week.

Standard Parental Benefits pays a weekly benefit of 55% for up to 35 weeks, while the Extended Parental Benefits pay 33% for up to 61 weeks. The maximum Standard Parental Benefits is $638, while the maximum Extended Parental Benefits is $383.

How will my weekly benefit rate be determined?

Total insurable earnings are based on your best weeks (the weeks you earned the most money), and are used to calculate your average weekly income. The number of best weeks calculated is based upon the unemployment rate in your region and can be anywhere in the range of 14 weeks to 22 weeks. Your total income for your best weeks is divided by your required number of best weeks.

For example Ex. Your total income is $45,000, it would be divided by 22 (lowest unemployment rate region) = $2045 weekly income

Your weekly income will then by multiplied by 55% for regular parental benefits and 33% for extended parental benefits.

To find out the rate of unemployment in your region, visit EI Program Characteristics.

12 Month Parental Leave Versus 18 Month Parental Leave:

This all depends on your household finances and job situations, however explained below is the total amount of money paid on Maternal Leave in Canada including Parental leave based on the maximum weekly benefits. Based on my calculations, if you take the 18 month leave you will need to be prepared to survive on $ over the 18 months, while you will get $ over the 12 month option.

Regular Parental Leave (12 months)

Maternity Leave of 15 weeks at 55% ($638) = $

Parental Leave of 35 Weeks at 55% ($638) =

TOTAL = $

Regular Parental Leave plus Extended Leave of 5 Weeks for Dads

Maternity Leave of 15 weeks at 55% ($638) =

Parental Leave of 61 weeks at 33% ($383) = $

Parental Leave for DADS Only 5 weeks at 33% ($383) = $

TOTAL = $

Extended Parental Leave (18 Months)

Maternity Leave of 15 weeks at 55% ($638) = $

Parental Leave of 61 weeks at 33% ($383) = $

TOTAL = $

Extended Parental Leave plus Extended Leave of 8 Weeks for Dads

Maternity Leave of 15 weeks at 55% ($638) =

Parental Leave of 61 weeks at 33% ($383) = $

Parental Leave for DADS Only 8 weeks at 33% ($383) = $

For your own unique situation you can use the Government of Canada Benefit Calculator to estimate your families benefits.

Extended Parental Leave (18 months)

Now, Maternity Leave can be exhausting, emotional, lonely, and exciting – basically it is one big roller coaster ride of unknown. The one thing that is certain is that the time flies by, and before you know it you have a 1 year old and are heading back to the working world. Navigating this new world called motherhood can be challenging and yet so rewarding, so it is important to make the most of the time you have off especially here in Canada as we are blessed to have a partially paid year off unlike our neighbours in the United States.

Once the fog of motherhood starts to settle at about the 2-3 month mark, you may be starting to think about what to do on maternity leave. There is a variety of things to do on maternity leave depending on your interests. Before you know it you will be going back to work after maternity leave. Making the most out of maternity leave is so important as your child will only be that small once, and the memories you share will last a lifetime specially with the use of digital cameras!

Can You Switch From The 12 To 18 Month Parental Leave?

Unfortunately once you make a decision on a 12 month Parental Leave or 18 Month Parental Leave, once the claim has been processed you cannot change your mind. It is very important to weigh all the pros and cons of the decision before deciding on length of parent leave. If you choose the 18 month parental leave and decide to go back to work early, you forfeit an owing money left on the claim.

Frequently Asked Questions:

Can both myself and my husband be paid at the same time?

Parents can be paid at the same time but it will deduct 2 weeks from the 35 week bank of weekly payments, 1 week of payment for each parent. However as of 2019 if dads decide to take time off work they are entitled to 5 weeks of their own that will not be deducted from the 35 week parental leave bank as long as both parents take time off work.

When can I start my maternity leave?

Maternity Leave can be started up to 12 weeks before your due date, but remember these weeks count in your total of 15 weeks of maternity leave, so it is suggested that your work as close as you can until baby is born. If you feel that working is becoming to difficult you can talk to your doctor about taking sick leave before baby is born. Due to my past car accident and back issues I was able to take 4 weeks of sick leave prior to maternity leave.

Can I work on Maternity or Parental Leave?

On Maternity Leave, the government will deduct $1 for every dollar you make, however on Parental Leave they will only deduct $0.50 off your benefit for every dollar you earn.

Do I get paid right away? Will I receive maternity benefits as soon as my child is born?

Be prepared that it takes a long time 2-3 weeks for Maternity and Parental Leave Claims to be processed. You also need to wait 1 week with no income as your waiting period (basically the same as a deductible on regular insurance).

What other financial support will I receive?

- Family Supplement – Eligible for net family income of $25,921

- Canada Child Benefit – Benefit to help with the cost of raising a child

Reference from Service Canada Website:

We automatically add your family supplement to your weekly benefit payments. You don’t need to take any action. Your total weekly amount cannot exceed $638.

How to Apply for Employment Insurance Benefits:

The Service Canada website will guide you through the process of applying to both parental and maternity benefits. You must also do a 1 week waiting period before any benefits can begin.

Information to Collect Before Applying to Employment Insurance Benefits:

- SIN (Social Insurance Number)

- Bank Direct Deposit Information

- Current Full Address

- Predicted Due Date

- SIN number for your spouse

- Actual Date of birth or date for the adoption of a child *Parental benefits*

- Names and addresses for your employment within the last 12-month period

- Record of Employment (ROE) from your current employer

Considerations when Returning to Work: Daycare Costs

Childcare costs can be more than your mortgage so it is really important to consider these costs into your calculation when making a decision about paid family leave benefits. Important things such as childcare costs can be the determining factor in deciding if it makes sense financially to return to work, and some families even choose for mothers to return to part-time work after the birth of a child so that parents can alternate watching the child.

Luckily in 2022, the government is finally decreasing the rate of childcare as it was reduced by 25% in Sept 2022 and parents will see a 50% reduction cost for 2023 with the ultimate goal of $10 a day daycare in 2025.

In my experience in a suburb just outside the Greater Toronto Area the costs for a licensed center range about $1300-1700 for an infant, and reduce when they become a toddler. In comparison, home daycares range about $800-1000 a month.

I hope this information clears up on any questions on Money and Maternity/Parental Leaves, it can be a confusing time when you are just becoming a new parent. This information will allow you to create a budget that works for your family and to feel in control of your families financial situation. Budgeting for a baby doesn’t have to be difficult, it just takes some research and planning.

How to Decide Between the 12 or 18 Month Parental Leave

Canadian mothers are so lucky to have paid parental leave, however the choice of taking a 12 month maternity leave or 18 month maternity leave can be difficult. In 2017, the Canadian government introduced the 18 month maternity leave to parents. This blog will look at the differences between a 12 month and 18 month maternity leave and all of the financial factors to consider before deciding.

Deciding how long of a maternity leave to take can be both an emotional decision (wanting to stay home with your child) and a financial decision (can you afford to stay on a reduced salary for longer), and is even trickier as a new mother to make when dealing with pregnancy hormones.

For the longest time. we put off having a child as we never felt financially ready or financially stable while all my friends would say “you are never financially ready but that you just figure out how to make it work”. So in 2018, we finally took the plunge and decided we were ready to have children.

Once you are actually pregnant you are excited at expanding your family, however the reality of a reduced income soon hits and you have to begin to determine how you will make your financial situation work.

18 Month Maternity Leave and How it Works:

*Now I am not an expert, nor an employer of Service Canada so all information presented is guidance and should be followed up with a phone call to Service Canada if still unclear.

The following information will help you understand Maternity Leave Financial Math and how the 18 Month Maternity Leave works.

With both of my maternity leaves in 2018 and 2021 I chose the 12 month leave as it financially made the most sense for our family but this isn’t always the case for each family.

Now maternity and parental leave is a huge financial challenge as you are not only living on a reduced income (55% of your salary on Canadian EI) but your expenses have been increased as you need to buy diapers, wipes, formula, clothes and baby gear.

You may also be interested in: Baby on a Budget: Tips to Save on the First Year or How to Save Money on Diapers, and Saving Money by Making Homemade Baby Food.

What is Maternity Leave? What is Parental Leave Option? How Long is Maternity Leave in Canada?

The paid parental leave program in Canada has two benefits: Maternity Leave and Paternal Leave which offer multiple weeks of leave to eligible employees in Canada. The number of weeks of maternity benefits and parental benefits are different when you have a new child. To be considered eligible you must have worked 600 hours in the past year (365 calendar days) before having the new baby.

Canadian maternity leave allows mother to have a combined 50 weeks off between Maternity Leave and Parental Leave. Maternity Leave is 15 weeks long and is only eligible to the birth moms of a child, while Parental leave is 35 weeks long (about 9 months of parental leave) and is eligible to both parents whether biological or adopted.

12 Month Maternity Leave

An important not is that all benefits must be used within 52 weeks of the child’s birth. Maternity leave in Canada allows mothers time to adjust to being a parent and to heal from the process of birthing a child. Parental Leave in Canada allows either parent time to take time off to care of their newborn, while their job is secured. This amount to just under a year long maternity and parental leave combined.

18 Month Maternity Leave

Extended Maternity leave allows mothers to have a combined 61 weeks off between Maternity Leave and Parental Leave. Maternity Leave is 15 weeks long and is only eligible to the birth mother of a child, while Parental leave is 46 weeks long and is eligible to both parents whether biological or adopted and offers extra time.

Changes to Maternity and Parental Leave in Canada: New Benefits

New in 2018

The Government of Canada created the option of an 18 month maternity and parental leave program which includes 15 weeks of maternity leave and 61 weeks of parental leave. The maternity leave policy in Canada is constantly changing and being improved to try and combat the changing of families and roles in the household.

New in 2019

Every dad should have the opportunity to take paternity leave – not only does it allow them to spend time with their young children, but I also think it makes them better fathers and husbands as they have a better understanding of what it takes to care for a child all day long. By having dads stay home this also breaks home the age old gender stereotypes that in 2018 are no longer relevant as women have jobs just as men do and in many cases can be the bread winner of the family.

Canadian maternity leave law states that businesses must allow fathers to take time off if they request it, and must hold their jobs. Quebec has for years encouraged fathers to take time off with their children and as a result 87% of fathers in Quebec have taken a parental leave, and as a result it has shown positive for kids.

As of June 2019, the Federal Government of Canada will introduce a 5 week use it or lose it incentive for new fathers to take parental leave. The way it will work is that fathers can take up to 5 weeks off in addition to the mother’s maternity and parental leave, adding up to a total of 55 weeks paid by employment insurance but only if both parents take time off work.

New in 2021

If parents are both taking parental benefits then dads are now eligible to take up to 8 weeks without taking away weeks from the opposite parents leave, this will allow families to take a total of 69 weeks.

When sharing, the maximum number of weeks available increases to:

- 40 weeks for standard parental

- 69 weeks for extended parental

Important Notes: The remaining 5 weeks of standard or 8 weeks of extended parental benefits are available on a use-it-or-lose-it basis: if taken, they can only be taken by the other parent(s). Parents can receive their weeks of benefits at the same time or one after another. Dads do not need to take the weeks consecutively however they must be taken within 52 weeks if 12 month option is chosen and 69 weeks if the 18 month option is chosen.

Important Terms in Regards to Maternity and Parental Leave:

Reference From Service Canada’s Website

EI maternity benefits are payable only to the biological mother who is unable to work because she is pregnant or has recently given birth. To receive maternity benefits, you need to prove your pregnancy by signing a statement declaring the expected due date or the actual date of birth.

EI parental benefits are payable only to the biological, adoptive, or legally recognized parents while they are caring for their newborn or newly adopted child or children. To receive parental benefits, you must sign a statement declaring the newborn’s date of birth or, when there is an adoption, the child’s date of placement for the purposes of the adoption and the name and address of the adoption authority. In cases where the child is not legally adoptable, parental benefits could be payable from the date you attest that you consider the placement a permanent one. In these circumstances, the Commission may, at any time, request proof certifying that the child for whom you are claiming parental benefits has been placed with you by a recognized authority and that the placement was not merely a temporary one.

For biological or legally recognized parents, EI parental benefits can be paid starting from the child’s date of birth. For adoptive parents, parental benefits can be paid starting from the date the child is placed with them for the purpose of adoption. In cases where the child is not legally adoptable, parental benefits could be payable from the date you attest that you consider the placement a permanent one.

Maternity Leave Benefits and Parental Leave Benefit Options: Benefit Amounts

Adding a new family member is exhausting and stressful on it’s own so planning ahead and determining what your benefit amounts will be during your maternity leave or extended parental leave is important to reduce stress and financial worries once baby has arrived.

12 Month Parental Leave: Standard Parental Benefits:

A 12 month Parental Leave pays 55% for the entire 50 weeks, 15 weeks of maternity benefits that are available to biological mothers or surrogate mothers that cannot work due to pregnancy. Standard parental benefits can be accessed as early as 12 weeks before the baby is born.

18 Month Extended Parental Leave Benefits

The 18 Month Maternity Leave does pay slightly more than a 12 month maternity leave however you need to extend this money for an additional six months. Determining how much money you will get paid is a big part of the financial decision. A 18 Month Parental Leave pays the same 55% for the first 15 weeks of maternity leave, and then for the remaining 61 weeks, the parent is paid at 33%. This can also be extended to a total of 69 weeks if the opposite parent takes parental leave as well. If you choose the 18 month leave then you will apply for Extended Parental Leave that will automatically start after maternity leave.

How much money does Canadian Maternity Leave Pay? What is the Maternity Benefit pay rate? What is the Parental Leave Benefit Rate? Use these amounts to figure out a budget for Maternity Leave.

Maternal leave in Canada is paid at 55% to a maximum yearly insurable salary of $60,300 based on your average weekly insurable earnings. This means the maximum amount that anyone can be paid is $638 per week pre tax. Pregnancy leave also known as maternity leave can be taken up to 12 weeks before baby is born but these weeks before baby is born come out of your total of 15 weeks of maternity leave. There are lots of things to do before baby comes but I highly suggest you figure out where, how, and when to apply for benefits as it can be a lengthy process.

The rate of Employment Insurance benefits depends on the option you choose:

Employment Insurance maternity benefits in Canada is 15 weeks and paid at 55% regardless of the parental benefit option you choose. Maternity leave policy in Canada can only be taken by the biological mother. Maternity pay is a maximum of $638 a week.

Standard Parental Benefits pays a weekly benefit of 55% for up to 35 weeks, while the Extended Parental Benefits pay 33% for up to 61 weeks. The maximum Standard Parental Benefits is $638, while the maximum Extended Parental Benefits is $383.

How will my weekly benefit rate be determined?

Total insurable earnings are based on your best weeks (the weeks you earned the most money), and are used to calculate your average weekly income. The number of best weeks calculated is based upon the unemployment rate in your region and can be anywhere in the range of 14 weeks to 22 weeks. Your total income for your best weeks is divided by your required number of best weeks.

For example Ex. Your total income is $45,000, it would be divided by 22 (lowest unemployment rate region) = $2045 weekly income

Your weekly income will then by multiplied by 55% for regular parental benefits and 33% for extended parental benefits.

To find out the rate of unemployment in your region, visit EI Program Characteristics.

12 Month Parental Leave Versus 18 Month Parental Leave:

This all depends on your household finances and job situations, however explained below is the total amount of money paid on Maternal Leave in Canada including Parental leave based on the maximum weekly benefits. Based on my calculations, if you take the 18 month leave you will need to be prepared to survive on $ over the 18 months, while you will get $ over the 12 month option.

Regular Parental Leave (12 months)

Maternity Leave of 15 weeks at 55% ($638) = $

Parental Leave of 35 Weeks at 55% ($638) =

TOTAL = $

Regular Parental Leave plus Extended Leave of 5 Weeks for Dads

Maternity Leave of 15 weeks at 55% ($638) =

Parental Leave of 61 weeks at 33% ($383) = $

Parental Leave for DADS Only 5 weeks at 33% ($383) = $

TOTAL = $

Extended Parental Leave (18 Months)

Maternity Leave of 15 weeks at 55% ($638) = $

Parental Leave of 61 weeks at 33% ($383) = $

TOTAL = $

Extended Parental Leave plus Extended Leave of 8 Weeks for Dads

Maternity Leave of 15 weeks at 55% ($638) =

Parental Leave of 61 weeks at 33% ($383) = $

Parental Leave for DADS Only 8 weeks at 33% ($383) = $

For your own unique situation you can use the Government of Canada Benefit Calculator to estimate your families benefits.

Extended Parental Leave (18 months)

Now, Maternity Leave can be exhausting, emotional, lonely, and exciting – basically it is one big roller coaster ride of unknown. The one thing that is certain is that the time flies by, and before you know it you have a 1 year old and are heading back to the working world. Navigating this new world called motherhood can be challenging and yet so rewarding, so it is important to make the most of the time you have off especially here in Canada as we are blessed to have a partially paid year off unlike our neighbours in the United States.

Once the fog of motherhood starts to settle at about the 2-3 month mark, you may be starting to think about what to do on maternity leave. There is a variety of things to do on maternity leave depending on your interests. Before you know it you will be going back to work after maternity leave. Making the most out of maternity leave is so important as your child will only be that small once, and the memories you share will last a lifetime specially with the use of digital cameras!

Can You Switch From The 12 To 18 Month Parental Leave?

Unfortunately once you make a decision on a 12 month Parental Leave or 18 Month Parental Leave, once the claim has been processed you cannot change your mind. It is very important to weigh all the pros and cons of the decision before deciding on length of parent leave. If you choose the 18 month parental leave and decide to go back to work early, you forfeit an owing money left on the claim.

Frequently Asked Questions:

Can both myself and my husband be paid at the same time?

Parents can be paid at the same time but it will deduct 2 weeks from the 35 week bank of weekly payments, 1 week of payment for each parent. However as of 2019 if dads decide to take time off work they are entitled to 5 weeks of their own that will not be deducted from the 35 week parental leave bank as long as both parents take time off work.

When can I start my maternity leave?

Maternity Leave can be started up to 12 weeks before your due date, but remember these weeks count in your total of 15 weeks of maternity leave, so it is suggested that your work as close as you can until baby is born. If you feel that working is becoming to difficult you can talk to your doctor about taking sick leave before baby is born. Due to my past car accident and back issues I was able to take 4 weeks of sick leave prior to maternity leave.

Can I work on Maternity or Parental Leave?

On Maternity Leave, the government will deduct $1 for every dollar you make, however on Parental Leave they will only deduct $0.50 off your benefit for every dollar you earn.

Do I get paid right away? Will I receive maternity benefits as soon as my child is born?

Be prepared that it takes a long time 2-3 weeks for Maternity and Parental Leave Claims to be processed. You also need to wait 1 week with no income as your waiting period (basically the same as a deductible on regular insurance).

What other financial support will I receive?

- Family Supplement – Eligible for net family income of $25,921

- Canada Child Benefit – Benefit to help with the cost of raising a child

Reference from Service Canada Website:

We automatically add your family supplement to your weekly benefit payments. You don’t need to take any action. Your total weekly amount cannot exceed $638.

How to Apply for Employment Insurance Benefits:

The Service Canada website will guide you through the process of applying to both parental and maternity benefits. You must also do a 1 week waiting period before any benefits can begin.

Information to Collect Before Applying to Employment Insurance Benefits:

- SIN (Social Insurance Number)

- Bank Direct Deposit Information

- Current Full Address

- Predicted Due Date

- SIN number for your spouse

- Actual Date of birth or date for the adoption of a child *Parental benefits*

- Names and addresses for your employment within the last 12-month period

- Record of Employment (ROE) from your current employer

Considerations when Returning to Work: Daycare Costs

Childcare costs can be more than your mortgage so it is really important to consider these costs into your calculation when making a decision about paid family leave benefits. Important things such as childcare costs can be the determining factor in deciding if it makes sense financially to return to work, and some families even choose for mothers to return to part-time work after the birth of a child so that parents can alternate watching the child.

Luckily in 2022, the government is finally decreasing the rate of childcare as it was reduced by 25% in Sept 2022 and parents will see a 50% reduction cost for 2023 with the ultimate goal of $10 a day daycare in 2025.

In my experience in a suburb just outside the Greater Toronto Area the costs for a licensed center range about $1300-1700 for an infant, and reduce when they become a toddler. In comparison, home daycares range about $800-1000 a month.

I hope this information clears up on any questions on Money and Maternity/Parental Leaves, it can be a confusing time when you are just becoming a new parent. This information will allow you to create a budget that works for your family and to feel in control of your families financial situation. Budgeting for a baby doesn’t have to be difficult, it just takes some research and planning.